Dutch Company Amdax to Introduce Bitcoin Treasury Listing on Euronext Amsterdam

Amdax, a Dutch cryptocurrency service provider, is on the verge of introducing a Bitcoin treasury company on Euronext Amsterdam, marking Europe's increasing acceptance of business Bitcoin initiatives, following the existing patterns in the United States.

On Monday, Amdax announced the launch of AMBTS B.V., a privately owned and independently managed company that will operate as a standalone firm. It plans to be a "1% Bitcoin treasury company" in the long term, seeking to hold 1% of the circulating supply of Bitcoin (BTC).

Based on current market prices, with Bitcoin at over $115,800, that would take over $24 billion in capital.

Amdax Boosts Bitcoin Strategy

Amdax announced that it would raise capital in tranches in the markets to enhance its Bitcoin holdings, increase equity value, and push its investors' Bitcoin-per-share ratios higher. The initial funding tranche will focus on private investors, and proceeds will be used to advance its plan of accumulating more Bitcoins.

Established in 2020, Amdax was the first crypto service provider to be registered with the Dutch Central Bank and was amongst the first companies to obtain a MiCA license from the Dutch Authority for the Financial Markets (AFM) on June 26.

Today, the Amdax platform provides 33 cryptocurrencies to trade, as well as automated investing and professionally managed portfolios.

European Corporate Bitcoin Adoption on the Rise

European corporate adoption of Bitcoin keeps increasing, even though overall exposure is still modest in most portfolios. Amdax CEO Lucas Wensing said:

"With more than 10% of the supply of Bitcoin in the hands of institutions, governments and corporations, we think this is the right time to create a Bitcoin treasury company to list on Euronext Amsterdam."

To date, at least 15 European businesses have disclosed holdings in Bitcoin as part of their balance sheets. Some of the notable ones are:

Bitcoin Group (Germany): 3,605 BTC

Smarter Web Company (UK): 2,395 BTC

The Blockchain Group (France): 1,653 BTC

Satsuma Technology (UK): 1,126 BTC

Other businesses with holdings of less than 1,000 BTC include Sweden's H100 Group, Samara Asset Group, CoinShares International Limited, Phoenix Digital Assets, Aker ASA, and several others.

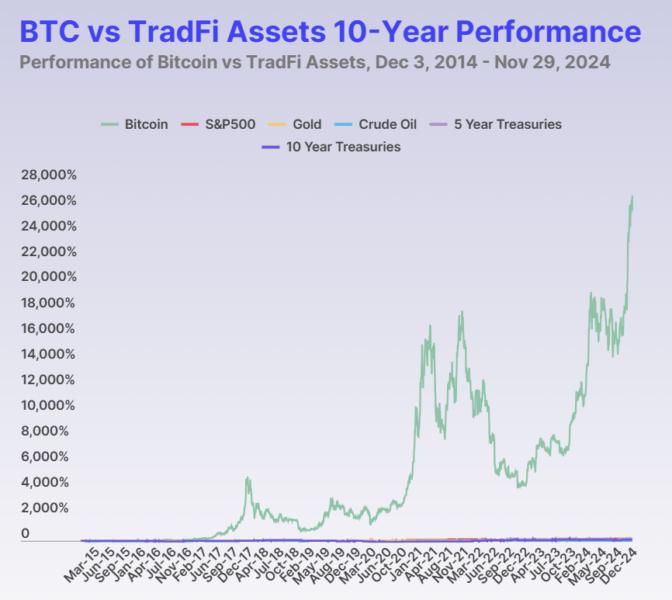

Bitcoin Remains the Best-Performing Asset

Over the past decade, Bitcoin has outperformed all major asset classes, delivering gains of 26,900%, compared to 193% for the S&P 500, 125% for gold, and 4.3% for crude oil, according to CoinGecko.

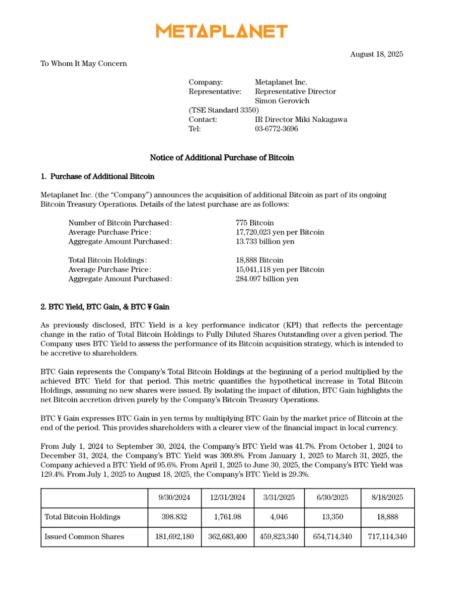

Outside of Europe and the US, adoption is also accelerating in Asia. Japanese investment firm Metaplanet recently acquired 775 BTC worth $89 million, pushing its total holdings to 18,888 BTC (valued at $2.1 billion).

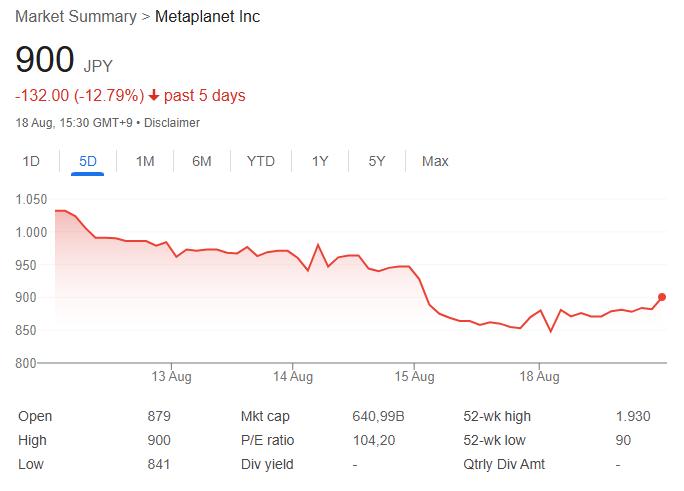

Even with a 190% year-to-date stock rally, Metaplanet's shares lost more than 12.7% in the last week and closed at 900 JPY ($6.11 per share), as per Google Finance.

By including relevant keywords and linking to related articles, the rewritten content aims to provide comprehensive information while enhancing search engine optimization for CryptoTelegraphs.

Join Telegram Channel For Daily New update: https://t.me/cryptotelegraphs_updates

0 Comments