Investors Gear Up for Powell Speech as Bitcoin Falls to Around $112K

Cryptocurrency investors are anxious in anticipation of the US Federal Reserve's traditional Jackson Hole meeting this Friday, as Chair Jerome Powell's speech will likely provide insight into interest rate policy in advance of September's FOMC meeting.

Bitcoin Falls to Two-Week Low

Bitcoin (BTCUSD) fell briefly to $112,565 on Wednesday, its two-week low since August 3, as per data from Cointelegraph.

The decline to below $113,000 is indicative of "heightening nerves in the market," according to Ryan Lee, Bitget exchange chief analyst, referencing spikes in fear among digital asset traders preceding Powell's address.

"Letting narratives settle and liquidity come back may set the stage for a rebound," Lee said, noting that if the support level of $112,000 holds, it could be the "setup to the next leg of the bull run rather than a reset."

Inflation Data and Rate Cut Expectations

Market jitters escalated after the most recent US Consumer Price Index (CPI) report on August 12, which reported consumer prices increasing 2.7% year-on-year, frozen since June, but still higher than the Fed's 2% goal.

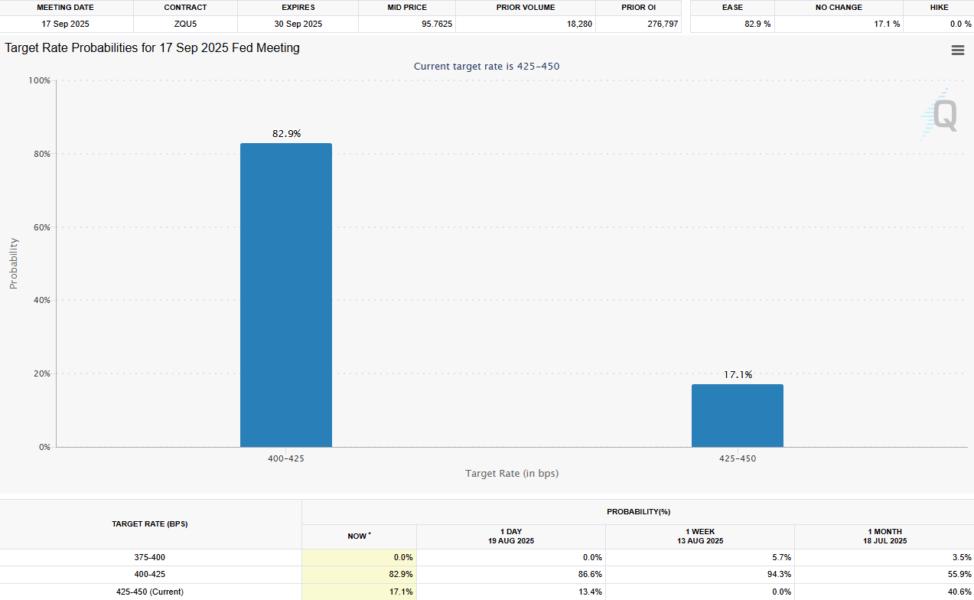

The CPI report deferred expectations of a September rate reduction, with probability dropping to 82% on Wednesday, down from more than 94% last week, based on the CME Group's FedWatch Tool.

Possible Catalyst: 2025 Rate Cuts

As per André Dragosch, European research head at Bitwise Asset Management, the initial rate cut by Fed in 2025 can become a powerful market driver.

"When you see further Fed rate cuts in the pipeline, the curve steepens, which means even more acceleration and US money supply growth," said Dragosch. He added that rate cuts are perhaps the most important macro factor to maintain the momentum of Bitcoin's rally, "at least through the end of the year."

Companies Continue Accumulation of Bitcoin

In spite of violent retail sentiment, companies and institutions continue to be focused on Bitcoin accumulation.

As of today, over 297 public institutions are Bitcoin holders, sharply higher than 124 in early June, as per BitcoinTreasuries.net.

Of these, there are 169 public firms, 57 private companies, 44 investment/ETF funds, and 12 governments, which together own 3.67 million BTC, or more than 17% of the Bitcoin supply.

By including relevant keywords and linking to related articles, the rewritten content aims to provide comprehensive information while enhancing search engine optimization for CryptoTelegraphs.

Join Telegram Channel For Daily New update: https://t.me/cryptotelegraphs_updates

0 Comments