BlackRock and Ethereum Drive Crypto Inflows to $3.75 Billion

Cryptocurrency products saw a huge jump in inflows during the last week, rising over six times higher than the week before. BlackRock and Ethereum (ETH), which propelled the rally together, dominated total market flows.

The rush in capital drove assets under management (AuM) to a new all-time high (ATH) of $244 billion, indicating increased institutional and retail demand for digital assets.

Crypto Inflows Surge Sixfold with BlackRock and Ethereum Leading the Charge

In its recent report, CoinShares confirmed that inflows into crypto investment products hit $3.75 billion for the week that ended August 16. That's a 6.4x increase from the previous week's $578 million.

CoinShares' head of research, James Butterfill, termed it the fourth-largest inflows on record, citing it as a strong turnaround following weeks of sluggish sentiment.

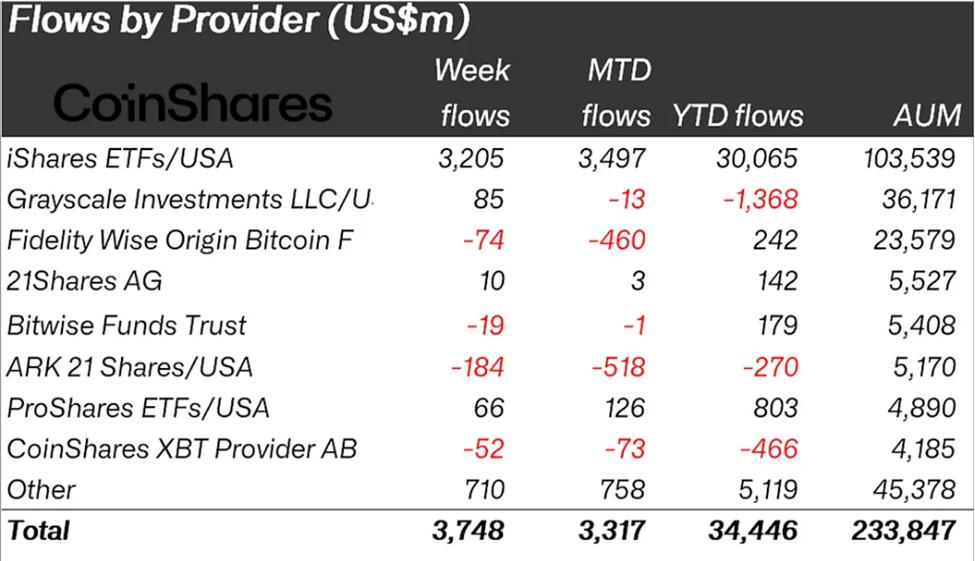

One of the main drivers was BlackRock's iShares ETF, which represented more than $3.2 billion of inflows, or 86% of the total last week.

"In a rare instance, nearly all the inflows were in one provider, iShares, and in one investment product," the report underscored.

BlackRock leads Provider Metrics

iShares ETF of BlackRock is deeply rooted as one of the major portals of crypto markets by institutions. BlackRock IBIT ETF has just been used by prestigious universities, such as Harvard University, to gain exposure, which shows the credibility of the fund.

Surprisingly, records show that three-quarters of buyers of the Bitcoin ETF issued by BlackRock were first-time buyers, which shows the growing leverage of the asset manager in introducing new customers.

To this trend, BlackRock's Ethereum ETF has been beating its Bitcoin fund over the past several weeks, indicating why both Ethereum and BlackRock are at the heart of recent inflows.

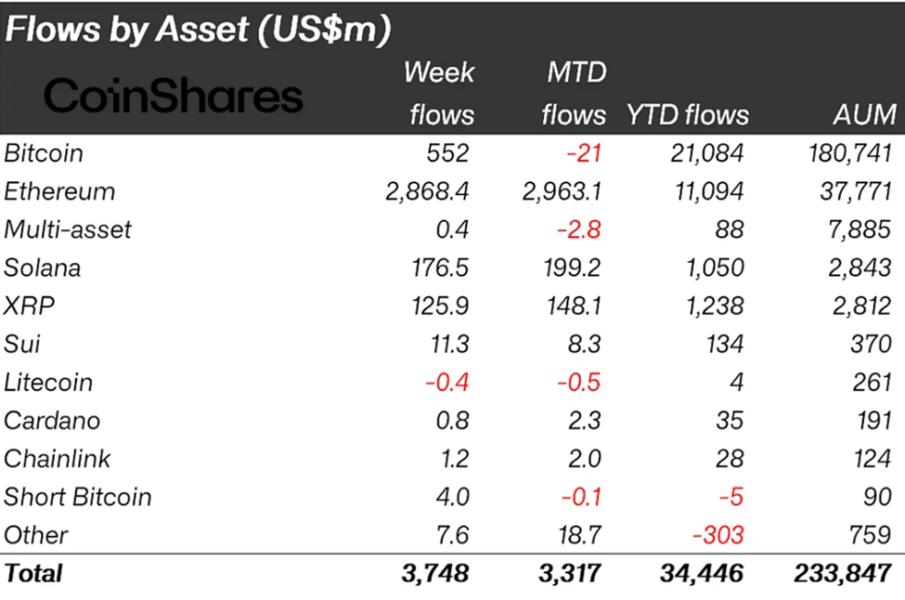

Ethereum is the Leading Asset in Inflows with a 77% Share

While BlackRock was hegemonic on the provider side, Ethereum was the star on asset statistics, taking 77% of overall weekly inflows.

"Ethereum keeps taking the spotlight, with inflows of a record $2.87 billion last week… dwarfing Bitcoin, with YTD inflows accounting for 29% of AuM vs. Bitcoin's 11.6%," Butterfill said.

Bitcoin, on the other hand, registered modest inflows of $552 million, following the trend of Ethereum beating BTC in institutional flows.

Ethereum has been the consistent leader of inflows in recent weeks, sometimes pushing crypto investment products to all-time highs, such as the latest $4.39 billion weekly high.

Institutional use of ETH for company treasuries and the growth of tokenized assets, currently worth a record $270 billion, have solidified Ethereum's leadership.

Against this context, analysts are indicating Ethereum's price may soon reach the $5,000 mark, approximately 20% above current levels.

By including relevant keywords and linking to related articles, the rewritten content aims to provide comprehensive information while enhancing search engine optimization for CryptoTelegraphs.

Join Telegram Channel For Daily New update: https://t.me/cryptotelegraphs_updates

0 Comments